Case Study Overview

Objective

To evaluate the economic viability of a business expansion project, applying financial mathematics and investment appraisal techniques to inform decision-making. This includes assessing funding options, projecting cash flows, and calculating key financial metrics such as Net Present Value (NPV).

Challenge

The analysis assumes consistent R$35k monthly profits starting immediately post-investment - any delay in market entry would extend the 8.57-month payback period. The 5% MARR requirement creates sensitivity to interest rate fluctuations, where a 0.6% increase would negate NPV advantages. Liquidity risk emerges from R$27k+ monthly repayments consuming 78% of projected profits, leaving minimal margin for operational variances. Opportunity cost considerations must account for alternative uses of the R$300k principal, particularly given Brazil's current 13.75% SELIC rate. Finally, the pet clothing market's unproven nature introduces demand uncertainty not captured in the static cash flow model.

Context

When studying Economic Engineering, our focus is on decision-making, and for this, it's crucial to understand the risks inherent in the project under analysis, utilising tools from financial mathematics and investment analysis. One of the most important decisions concerns the economic feasibility analysis of a particular investment, determining whether or not it should be made by the company.

In this context, you are the professional responsible for the control and management of production at the Lucy clothing industry and retail business, located in the municipality of Cianorte/PR. The privately held company was founded in the late 1990s by Mrs. Lúcia, who transformed her small atelier into a women's clothing factory. Over the years, the company expanded to other municipalities in Paraná and São Paulo. Currently, the company, which employs more than a thousand direct and indirect employees, has three own brands and serves major retail stores, is analysing the possibility of purchasing new equipment to enter a new market niche: pet clothing, especially for cats and dogs.

Thus, the final question to be answered by you, the professional responsible for the project, is "considering only the economic and financial aspects, is the acquisition of equipment to expand the business economically viable at this time?" To make this decision, you will need to conduct the necessary analyses and present the results directly to Mrs. Lúcia.

Let's go!

First Stage

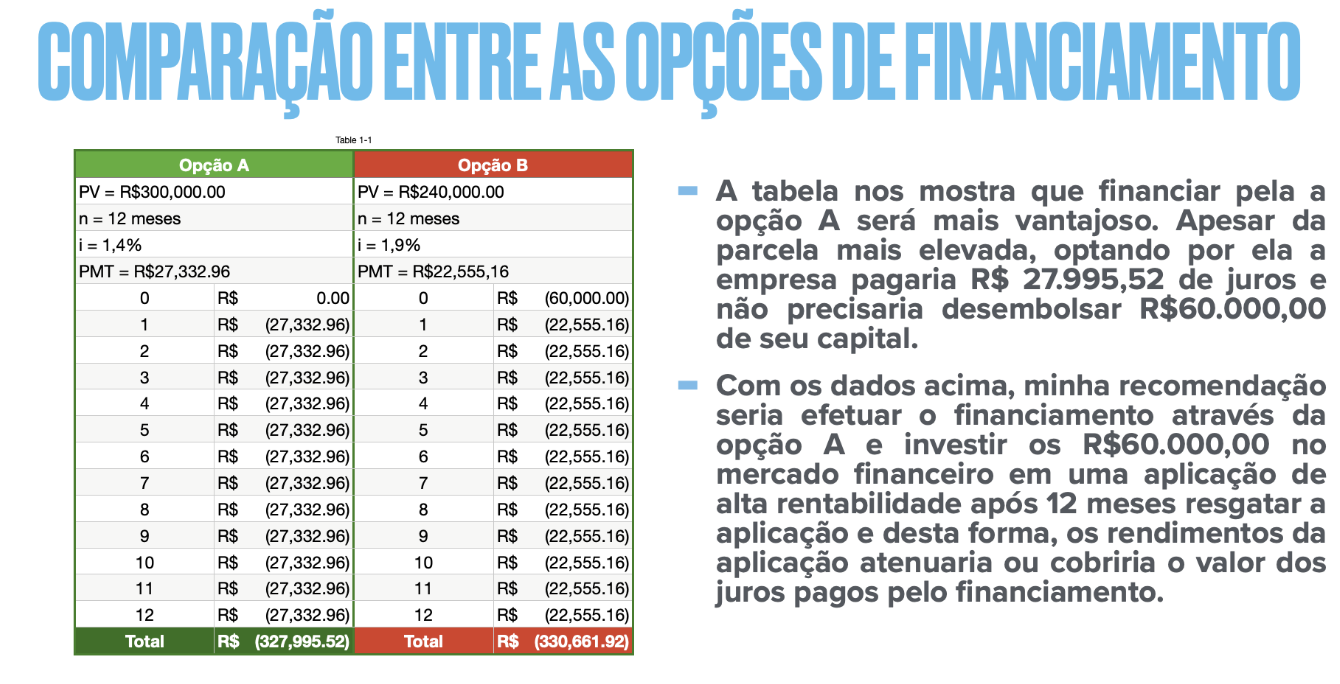

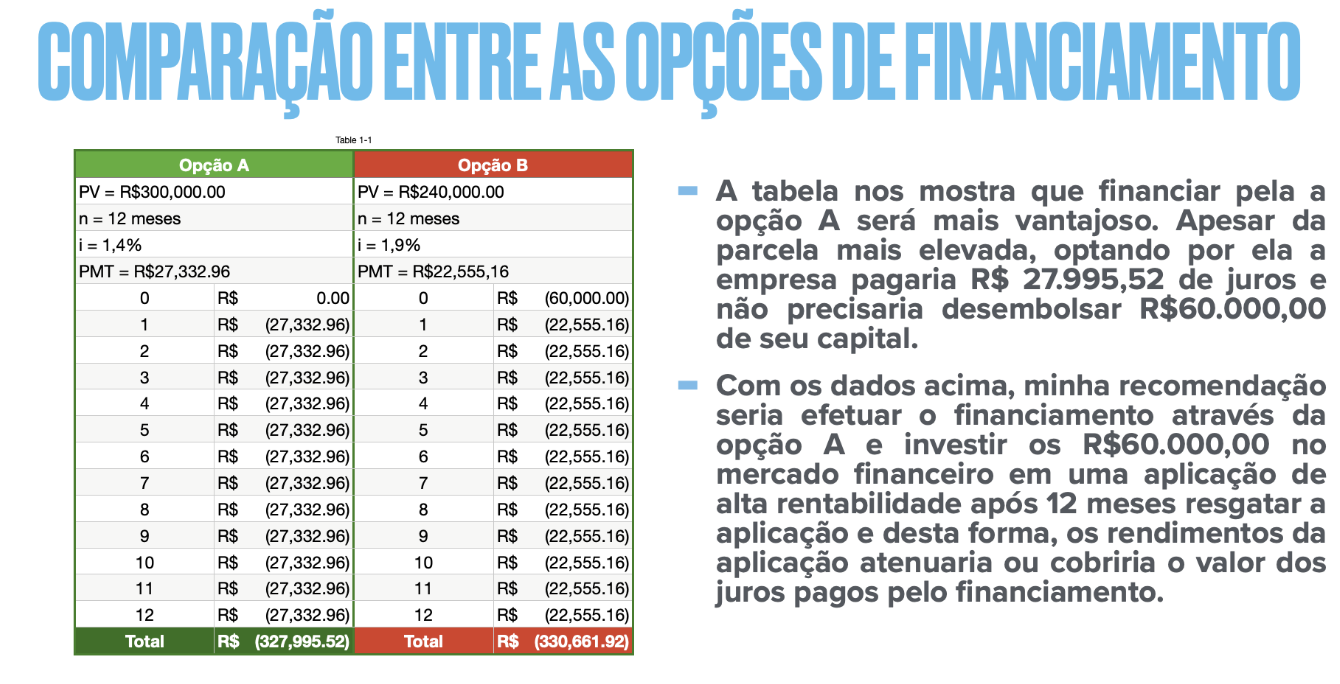

The first stage is to define what would be the best source of investment financing, since the company would prefer to make the purchase of the equipment in cash but does not wish, for strategic reasons, to fully utilise its own capital for this purpose.

Knowing that the equipment costs R$ 300,000.00, verify and demonstrate whether it would be more advantageous for the company to finance 100% of the equipment value in 12 fixed monthly instalments in arrears, with no down payment, at an interest rate of 1.4% per month under compound capitalisation (option A) or to integrate 20% of the equipment value with its own capital and finance 80% in 12 fixed monthly instalments, also in arrears, with no down payment, at an interest rate of 1.9% per month under compound capitalisation (option B).

Defining the amount of each installment:

\[PMT=PV(\frac{i(1+i)^n}{(1+i)^n-1})\]Option A:

Given:

- n = 12 months

- i = 1.4%

- PV = R$ 300000

Option B:

Given:

- n = 12 months

- i = 1.9%

- PV = R$ 240000

| Option A | |

|---|---|

| PV = R$ 300,000.00 | |

| n = 12 meses | |

| i = 1,4% | |

| PMT = R$ 27,332.96 | |

| Period | Amount |

| 0 | R$ 0.00 |

| 1 | R$ 27,332.96 |

| 2 | R$ 27,332.96 |

| 3 | R$ 27,332.96 |

| 4 | R$ 27,332.96 |

| 5 | R$ 27,332.96 |

| 6 | R$ 27,332.96 |

| 7 | R$ 27,332.96 |

| 8 | R$ 27,332.96 |

| 9 | R$ 27,332.96 |

| 10 | R$ 27,332.96 |

| 11 | R$ 27,332.96 |

| 12 | R$ 27,332.96 |

| Total | R$ 327,995.52 |

| Option B | |

|---|---|

| PV = R$ 240,000.00 | |

| n = 12 meses | |

| i = 1,9% | |

| PMT = R$ 22,555.16 | |

| Period | Amount |

| 0 | R$ 60,000.00 |

| 1 | R$ 22,555.16 |

| 2 | R$ 22,555.16 |

| 3 | R$ 22,555.16 |

| 4 | R$ 22,555.16 |

| 5 | R$ 22,555.16 |

| 6 | R$ 22,555.16 |

| 7 | R$ 22,555.16 |

| 8 | R$ 22,555.16 |

| 9 | R$ 22,555.16 |

| 10 | R$ 22,555.16 |

| 11 | R$ 22,555.16 |

| 12 | R$ 22,555.16 |

| Total | R$ 330,661.90 |

The table shows us that financing through option A will be more advantageous. Despite the higher instalment amount, by choosing it the company would pay R$ 27,995.52 in interest and would not need to disburse R$ 60,000.00 from its capital. With the data above, my recommendation would be to carry out the financing through option A and invest the R$ 60,000.00 in the financial market in a high-yield investment. After 12 months, redeem the investment and, in this way, the investment returns would lessen or cover the amount of interest paid for the financing.

Financial Analysis:

For the analysis of the financing system, as the value of the instalments are equal,

the system used would be the Price system of amortisation.

| PRICE System of Amortization - Option A | ||||

|---|---|---|---|---|

| Period | Interest | Amortization | Installment | Balance |

| 0 | R$ 0.00 | R$ 0.00 | R$ 0.00 | R$ 300,000.00 |

| 1 | R$ 4,200.00 | R$ 23,132.96 | R$ 27,332.96 | R$ 276,867.04 |

| 2 | R$ 3,876.14 | R$ 23,456.82 | R$ 27,332.96 | R$ 253,410.22 |

| 3 | R$ 3,547.74 | R$ 23,785.22 | R$ 27,332.96 | R$ 229,625.00 |

| 4 | R$ 3,214.75 | R$ 24,118.21 | R$ 27,332.96 | R$ 205,506.79 |

| 5 | R$ 2,877.10 | R$ 24,455.86 | R$ 27,332.96 | R$ 181,050.93 |

| 6 | R$ 2,534.71 | R$ 24,798.25 | R$ 27,332.96 | R$ 156,252.68 |

| 7 | R$ 2,187.54 | R$ 25,145.72 | R$ 27,332.96 | R$ 131,107.26 |

| 8 | R$ 1,835.50 | R$ 25,497.46 | R$ 27,332.96 | R$ 105,609.80 |

| 9 | R$ 1,478.54 | R$ 25,854.42 | R$ 27,332.96 | R$ 79,755.38 |

| 10 | R$ 1,116.58 | R$ 26,216.38 | R$ 27,332.96 | R$ 53,538.99 |

| 11 | R$ 749.55 | R$ 26,583.41 | R$ 27,332.96 | R$ 26,995.58 |

| 12 | R$ 377.38 | R$ 26,995.58 | R$ 27,332.96 | R$ 0.00 |

| Total | R$ 27,995.52 | R$ 300,000.00 | R$ 327,995.52 | |

| PRICE System of Amortization - Option B | ||||

|---|---|---|---|---|

| Period | Interest | Amortization | Installment | Balance |

| 0 | R$ 0.00 | R$ 0.00 | R$ 0.00 | R$ 240,000.00 |

| 1 | R$ 4,560.00 | R$ 17,995.16 | R$ 22,555.16 | R$ 222,004.84 |

| 2 | R$ 4,218.09 | R$ 18,337.07 | R$ 22,555.16 | R$ 203,667.78 |

| 3 | R$ 3,869.69 | R$ 18,685.47 | R$ 22,555.16 | R$ 184,982.31 |

| 4 | R$ 3,514.66 | R$ 19,040.49 | R$ 22,555.16 | R$ 165,941.81 |

| 5 | R$ 3,152.89 | R$ 19,402.26 | R$ 22,555.16 | R$ 146,539.55 |

| 6 | R$ 2,784.25 | R$ 19,770.91 | R$ 22,555.16 | R$ 126,768.64 |

| 7 | R$ 2,408.70 | R$ 20,146.55 | R$ 22,555.16 | R$ 106,622.09 |

| 8 | R$ 2,025.82 | R$ 20,529.84 | R$ 22,555.16 | R$ 86,092.75 |

| 9 | R$ 1,635.76 | R$ 20,919.40 | R$ 22,555.16 | R$ 65,173.25 |

| 10 | R$ 1,238.29 | R$ 21,316.86 | R$ 22,555.16 | R$ 43,856.49 |

| 11 | R$ 833.27 | R$ 21,721.88 | R$ 22,555.16 | R$ 22,134.60 |

| 12 | R$ 420.56 | R$ 22,134.60 | R$ 22,555.16 | R$ 0.00 |

| Total | R$ 30,661.90 | R$ 240,000.00 | R$ 270,661.90 | |

Second Stage

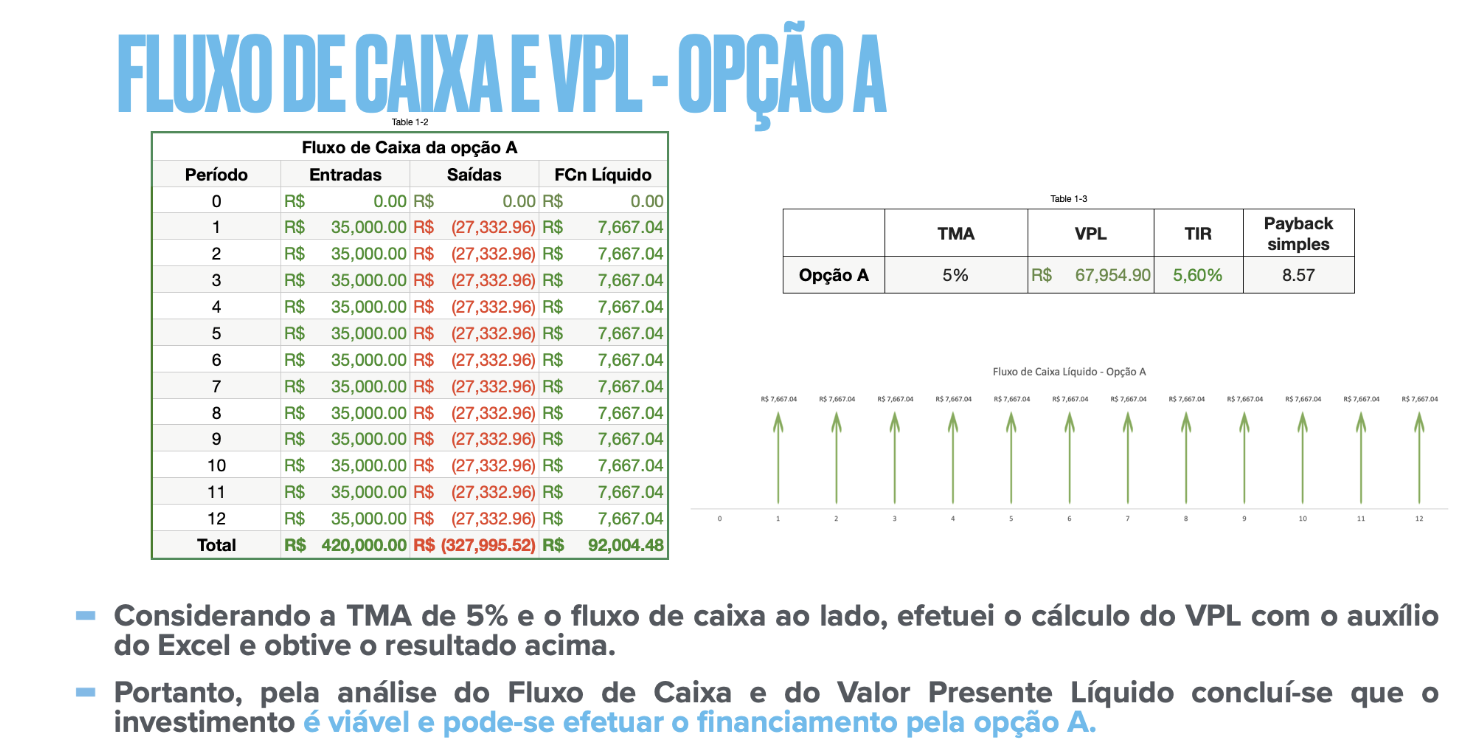

Now is the time to verify the economic and financial feasibility of the project and give your final opinion. To make this possible, the first step is to project the cash flow, considering, in an integrated way, the expected gains from the investments and the costs of the financing identified in the previous stage as the most advantageous.

Knowing that the monthly profit from the investment, which would start one month after the acquisition of the equipment, would be R$ 35,000.00 and that the Minimum Rate of Attractiveness (MRA) imposed is 5% per month as well as that the expected payback time is 12 months, calculate the Net Present Value (NPV) considering the period of one year (12 months of project return) and, based on the result obtained, give your opinion as to the feasibility of the investment.

| Cashflow- Option A | |||

|---|---|---|---|

| Period | Earnings | Expenses | Liquid Cash Flow |

| 0 | R$ 0.00 | R$ 0.00 | R$ 0.00 |

| 1 | R$ 35,000.00 | R$ (27,332.96) | R$ 7,667.04 |

| 2 | R$ 35,000.00 | R$ (27,332.96) | R$ 7,667.04 |

| 3 | R$ 35,000.00 | R$ (27,332.96) | R$ 7,667.04 |

| 4 | R$ 35,000.00 | R$ (27,332.96) | R$ 7,667.04 |

| 5 | R$ 35,000.00 | R$ (27,332.96) | R$ 7,667.04 |

| 6 | R$ 35,000.00 | R$ (27,332.96) | R$ 7,667.04 |

| 7 | R$ 35,000.00 | R$ (27,332.96) | R$ 7,667.04 |

| 8 | R$ 35,000.00 | R$ (27,332.96) | R$ 7,667.04 |

| 9 | R$ 35,000.00 | R$ (27,332.96) | R$ 7,667.04 |

| 10 | R$ 35,000.00 | R$ (27,332.96) | R$ 7,667.04 |

| 11 | R$ 35,000.00 | R$ (27,332.96) | R$ 7,667.04 |

| 12 | R$ 35,000.00 | R$ (27,332.96) | R$ 7,667.04 |

| Total | R$ 420,000.00 | R$ (327,995.52) | R$ 92,004.48 |

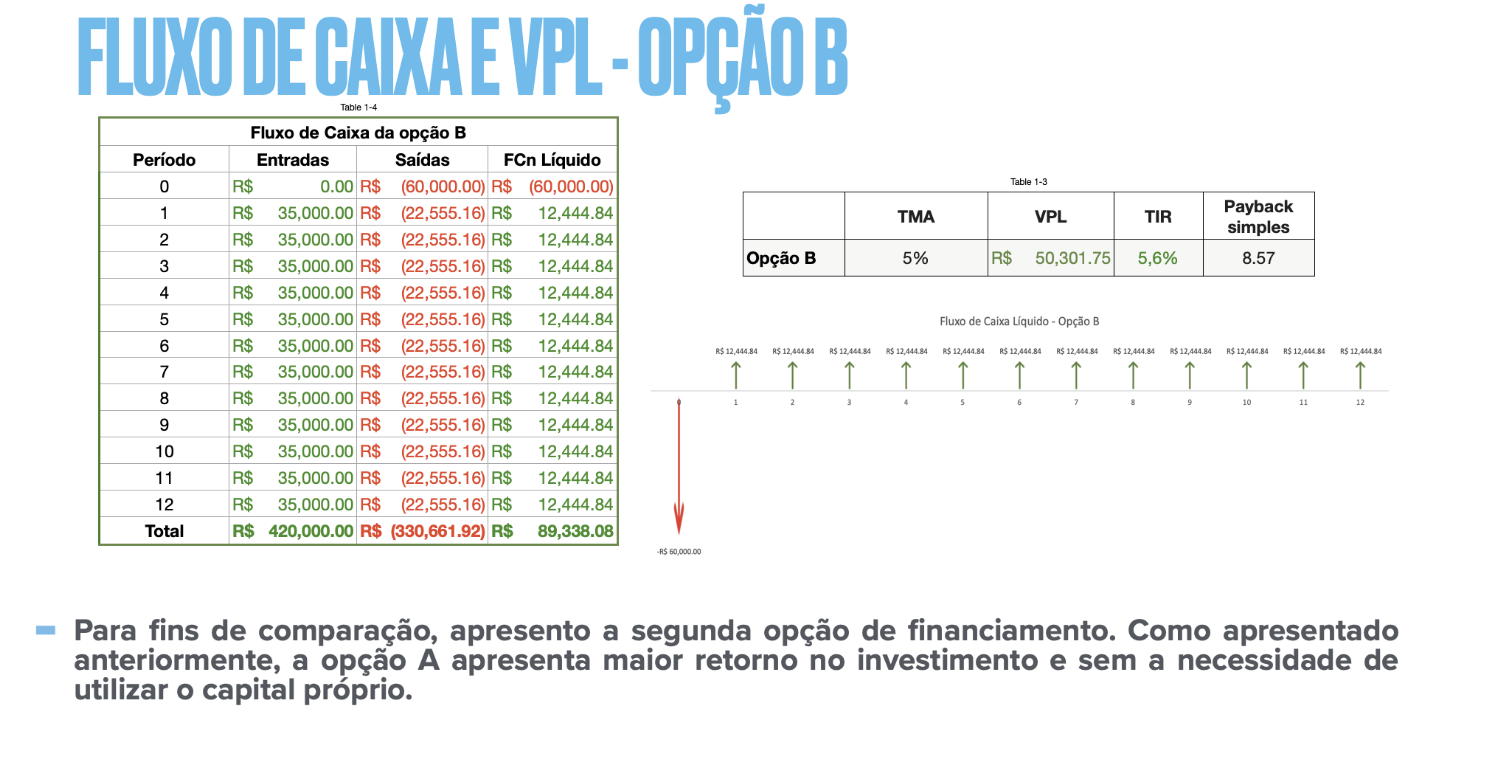

| Cashflow- Option B | |||

|---|---|---|---|

| Period | Earnings | Expenses | Liquid Cash Flow |

| 0 | R$ 0.00 | R$ (60,000.00) | R$ (60,000.00) |

| 1 | R$ 35,000.00 | R$ (22,555.16) | R$ 12,444.84 |

| 2 | R$ 35,000.00 | R$ (22,555.16) | R$ 12,444.84 |

| 3 | R$ 35,000.00 | R$ (22,555.16) | R$ 12,444.84 |

| 4 | R$ 35,000.00 | R$ (22,555.16) | R$ 12,444.84 |

| 5 | R$ 35,000.00 | R$ (22,555.16) | R$ 12,444.84 |

| 6 | R$ 35,000.00 | R$ (22,555.16) | R$ 12,444.84 |

| 7 | R$ 35,000.00 | R$ (22,555.16) | R$ 12,444.84 |

| 8 | R$ 35,000.00 | R$ (22,555.16) | R$ 12,444.84 |

| 9 | R$ 35,000.00 | R$ (22,555.16) | R$ 12,444.84 |

| 10 | R$ 35,000.00 | R$ (22,555.16) | R$ 12,444.84 |

| 11 | R$ 35,000.00 | R$ (22,555.16) | R$ 12,444.84 |

| 12 | R$ 35,000.00 | R$ (22,555.16) | R$ 12,444.84 |

| Total | R$ 420,000.00 | R$ (330,661.92) | R$ 89,338.08 |

Considering the Minimum Acceptable Rate of Return (MARR) of 5% and the cash flow above, I performed the Net Present Value (NPV) calculation and obtained the following result:

| NPV Option A | R$ 67,954.90 | ||

| NPV Option B | R$ 50,301.75 | ||

| IRR | 5.60% | ||

| Simple Payback | 8.57 | ||

| Investment | R$ 300,000.00 | ||

| i | 5.00% |

| Cash Flow | |||

|---|---|---|---|

| Period | Cash Flow Option A | Cash Flow Option B | IRR |

| 0 | R$ 0.00 | R$ (60,000.00) | R$ (300,000.00) |

| 1 | R$ 7,667.04 | R$ 12,444.84 | R$ 35,000.00 |

| 2 | R$ 7,667.04 | R$ 12,444.84 | R$ 35,000.00 |

| 3 | R$ 7,667.04 | R$ 12,444.84 | R$ 35,000.00 |

| 4 | R$ 7,667.04 | R$ 12,444.84 | R$ 35,000.00 |

| 5 | R$ 7,667.04 | R$ 12,444.84 | R$ 35,000.00 |

| 6 | R$ 7,667.04 | R$ 12,444.84 | R$ 35,000.00 |

| 7 | R$ 7,667.04 | R$ 12,444.84 | R$ 35,000.00 |

| 8 | R$ 7,667.04 | R$ 12,444.84 | R$ 35,000.00 |

| 9 | R$ 7,667.04 | R$ 12,444.84 | R$ 35,000.00 |

| 10 | R$ 7,667.04 | R$ 12,444.84 | R$ 35,000.00 |

| 11 | R$ 7,667.04 | R$ 12,444.84 | R$ 35,000.00 |

| 12 | R$ 7,667.04 | R$ 12,444.84 | R$ 35,000.00 |

In addition to the NPV, I have calculated other indicators to aid in decision-making.

Therefore, through the analysis of the Cash Flow and the Net Present Value, it was concluded

that the

investment is viable and the most advantageous financing option would be option A.

Furthermore, I performed an analysis of the payback period of the investment value and the

IRR.

Presenting the Results

Right then, it's time for you to put together the material to present to the company owner. There's a template/model available in the module materials that you can use – it's not compulsory, though. This material, which makes up your M.A.P.A. assignment, needs to include all the development and answers from the previous sections. You can submit the assignment as a text file, image, spreadsheet, or in PDF format.

The quality of your work will be taken into account when it's marked, so fill everything in carefully, explain what you're doing, answer the questions, and always show each step of your solutions. The more complete your work, the better!

To present the results, I would organize the data in a visual PowerPoint presentation as below (for illustration and enrichment of the M.A.P.A. only):

Investment Analysis

Implementation Outcomes

Financial Performance Achievements

- R$67,954.90 NPV achieved with Option A

- 5.6% IRR exceeds 5% MARR threshold

- R$27,995.52 total interest saved vs Option B

- 8.57-month payback meets 12-month target

- R$60k capital preserved for secondary investments

- Price amortization optimal for cash flow

Technical Validation

The financial analysis demonstrated:

- Effective Price amortization implementation

- Accurate DCF modeling at 5% monthly rate

- Clear cash flow visualization through linear charts